Start-up India Scheme is a flagship initiative of the Government of India, intended to build a strong eco-system for nurturing innovation and Startups in the country. The keyword is innovation. The business either develops a new product/ service or redevelops a current product/service into something better.

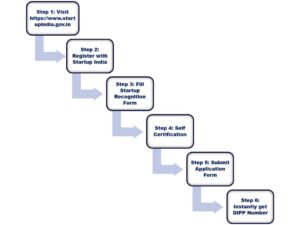

How to register your startup with Startup India:

Step 1: Visit https://www.startupindia.gov.in

Once your business is incorporated as a Private Limited Company or a Partnership firm or a Limited Liability Partnership, you must first visit https://www.startupindia.gov.in. An entity shall be considered as a startup up to 7 years from the date of its incorporation or 10 years in case of Startups in the Bio Technology sector.

Step 2: Register with Startup India

The next steps is to get recognised as a startup to avail benefits including tax-holidays. The entire process is online. The process begins with logging on to the above-mentioned website and register your business.

Step 3: Fill Startup Recognition Form

The Startup Recognition Form is divided in 6 parts.

- Entity Details

- Address Details

- Authorised Representative Details

- Director(s)/Partner(s)/Designated Partner(s) details

- Basic Information

- Start-up Activity

Though simple, these details needs to be filled carefully. Every statement you write is carefully evaluated, to determine whether or not your business is eligible to be recognized as a start-up.

Step 4: Self Certification

E-governance and self-certification go hand-in-hand. Accordingly, one must self-certify following statements, after proper evaluation as to their correctness. False self-certification may lead to rejection of application along with penalty.

a) You must register your new company as a Private Limited Company, Partnership firm or a Limited Liability Partnership

b) Your business must be incorporated/registered in India, not before 7 years. (10 years in case of Startups in the Biotechnology sector)

c) Turnover must be less than 25 crores per year.

d) Entity is working towards innovation, development or improvement of products or processes or services, or if it is a scalable business model with a high potential of employment generation or wealth creation.

e) Your business must not be as a result of splitting up or reconstruction of an existing business.

Step 5: Submit Application Form

Once the Self Certification is done, the respective Private Limited Company or a Partnership firm or a Limited Liability Partnership at startup India shall submit the Startup Recognition Form.

Step 6: Get recognized as a start-up – Get DIPP number

On applying you get a recognition number (DIPP Number) for your startup. The certificate of recognition will be issued after the examination of all your documents.

DIPP may, after calling for such documents or information and making such enquiries, as it may deem fit,

a. Recognise the eligible entity as a startup; or

b. Reject the application by providing reasons.

However, be careful while uploading the documents. If on subsequent verification, it is found to be obtained that the required document is not uploaded/wrong document uploaded or a forged document has been uploaded then you shall be liable to a fine of 50% of your paid-up capital of the startup with a minimum fine of Rs. 25,000.

At Bhaskara Consulting Group (BCG), we have advised companies at every stageof inception, growth and maturity. With this expertise in mind, we have outlined the various stages, right from the inception of an idea, which a start-up typically goes through in the process of its development.

Furthermore, we provide end-to-end assistance to obtain certificate under Form 1 for claiming tax-holiday under section 80IAC of the Income Tax Act, 1961.

For professional guidance, please do not hesitate to contact your start-up advisor at +91 9757135306 or at hitarth.sheth@bhaskara.in.

Disclaimer: This article is for the purpose of general awareness and does not represent professional opinion of the author.

great and nice ost

Very good blog post. I absolutely love this site.

Keep it up!