The GST (Amendment) Act, 2018 was recently brought into effect from 1st February 2019. Out of the amendments made, the introduction of Section 49A is particularly noteworthy, as the newly introduced section has changed the dynamics of set-off of Input Tax credit against the output liability. This will create cashflow crunch and lead to demand for additional working capital.

Q. 1 How will it create a cashflow crunch?

Q.2 Will all business face cashflow crunch?

The answer to these questions are explained below:

A. Firstly, let us understand the amendment comparing pre and post amendment scenarios.

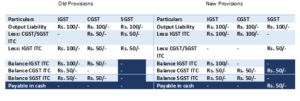

Tax credit adjustment as per earlier provisions:

Tax credit adjustment as per amended provisions:

B. Now, let us consider a numerical example to better understand the IMPACT of amendment.

Let us say, at end of February, 2019, tax credit and tax liability appears as below:

IGST output liability – Rs. 100

CGST output liability – Rs. 100

SGST output liability – Rs. 100

IGST ITC – Rs. 200

CGST ITC – Rs. 50

SGST ITC – Rs. 50

C. Let us now answer Question no. 1 given above:

As is evident from the table, under the old provisions, the entire amount of ITC was utilised and no amount of GST was payable in cash. However, under the new provisions, CGST ITC to the extent of Rs. 50/- remains unutilized and SGST liability to the extent of Rs. 50/- is payable in cash.

D. Lastly, let’s look at answer to Question no. 2:

The answer is NO. The amendment will create a negative impact on cashflows of those businesses, which primarily have greater inter-state purchases and relatively lesser inter-state sale. Therefore, businesses dealing in the imported as well as local items, manufacturers dependent on raw materials from other states and businesses not trading in locally manufactured goods are looking at cashflow challenges.

Geographically, businesses of less industrialised states, unfortunately, will be more affected since their, inter-state procurement would be substantially higher than inter-state sales.

E. Conclusion

The above amendment seems to be well thought out change meant to prepone GST collection for government, burden of which will be spread over several business entities. While larger companies may find it simpler to tide over the liquidity crunch due to easy access to finance, the MSMEs may find it difficult to deal with cashflow crunch in short to medium term.

Apart from borrowing, business can adopt other innovative solutions as well, to face cash-flow challenge.

Kindly get in touch with us for further information and assistance.

Disclaimer: This article is for the purpose of general awareness and does not represent professional opinion of the author.