India is witnessing emergence of generation of freelancers who would rather be their own boss, than work in an organization. Freelancers promote their services, follow leads, negotiate contracts and provide their technical and manual services to client/s. In this sense, they are business owners. This is exactly how their income is treated under Income Tax Act.

Freelancing Income

Freelancers are hired either for specific time or specific project or both. Being a freelancer, you are not an employee of your client. Therefore, freelancing income cannot be treated as ‘salary’. Any income generated from providing professional and technical services are classified as ‘business income’.

Only the income calculated after deducting expenses from the receipts are taxable. Accordingly, a freelancer must keep neat records of receipts from clients and expenses.

Tax deduction of Expenses

Though, net taxable income is computed after allowing deduction of expenses, not all expenses are deductible.

Conditions to claim expenses as deductions are:

- Expense is incurred for service you provide;

- It is not personal expense or capital expenditure;

- Expenses is wholly and exclusively for freelancing activity;

- It is not an illegal expense (for instance, bribe).

Illustrative list of expenses is:

- Software subscription,

- Internet and communication expense,

- Website and/or App maintenance;

- Work related travelling costs,

- Rent of co-working space or office rented,

- Utility bills;

- Other office expenses such as supplies, refreshments, etc.

It is important to note that, an asset such as laptop, office furniture, etc. you purchase for providing your services are treated as business assets. Depreciation on these assets is tax deductible.

Tax deductions of investments

Being a freelancer, you do not enjoy social security benefits such as Employee Provident Fund, group medical Insurance and Gratuity which are usually available to employees of an organization. Additionally, unlike people in 9 to 5 jobs, you do not enjoy predictable flow of income.

Therefore, it is prudent for a freelancer to save and invest portion of their income. Certain carefully planned investments can be claimed as deduction from income and reduce your tax liability.

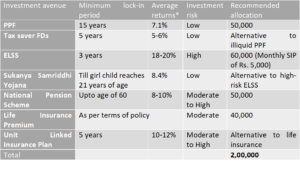

Illustrative allocation of investment is given below. Actual investment plan will depend on your risk appetite and goals.

*Actual returns differ based factors such as nature of product, asset managing company, insurance company, etc.

Instead of above investments, there are certain expense-based deductions such as re-payment of home loan and payment of tuition fees that can be availed to reduce tax.

Advance Tax and TDS on freelancer’s income

Advance tax is an income tax to be paid during the financial year. Therefore, it has to be calculated based on estimated income you foresee to earn during the year.

For calculation of advance tax, we need to compute taxable income first.

- Total Income = Net profit + Other incomes

- Net profit = Expected total fees charged to clients – Estimated expenses

- Other incomes = Interest from bank deposits + Gains from stock market, if any + Rent income, if any.

- Taxable income = Total income – Investment-based or expense-based deduction (discussed above)

Next step is to calculate tax on taxable income by applying applicable rates. If tax so calculated is Rs. 10,000 or more, you are required to pay advance tax.

However, actual amount of advance tax will be determined after reducing the amount of TDS deducted by your clients.

Non-payment and delayed payment of advance tax invites interest of 1% per month.

TDS (Tax Deduction at Source) on Freelancer’s receipts

When your clients make payment for your service, they will usually deduct tax of 10%. Tax so deducted will be deposited to government on your behalf.

TDS accumulated in your account can be utilized to pay your tax liability of that year. Excess balance of TDS will be refunded to you after you file your tax return for that year.

Based on your estimates, you can apply for deduction of tax at lower rates than 10%.

Accounting and Book-keeping for freelancers

Book-keeping will help you to keep track of your incomes, work related expenses and personal expenses. Having clear view of profits will not only help with tax calculation but also instill financial discipline.

You can self-manage your accounts on softwares like Zoho books and Quickbooks with initial handholding and training from professionals.

We at Bhaskara Consulting Group are on mission to make freelancers hailing from different educational backgrounds self-reliant and financially aware.

GST on freelancers

After getting comprehensive understanding of Income Tax, you may be wondering about GST implications on your freelancing receipts.

GST Act provides for threshold of Rs. 20 lakh for mandatory registration. In other words, you can choose not to get GST registration until your total receipts in a year cross Rs. 20 lakhs. However, there are various other factors to decide an ideal point of time to get voluntarily registered under GST. These factors have been discussed in a separate article.

We hope this article have helped you to understand income tax concepts applicable to you. For deeper discussion or queries, feel free to reach us at cakevalm@gmail.com.

Disclaimer: This article is for the purpose of general awareness and does not represent professional opinion of the author.