“With the great income, comes even greater tax” – No! Spiderman didn’t say that! But he might as well have!

This is true most of the times because income tax is normally progressive tax – means more income, higher rate of tax. Fortunately, this is not true for tax on capital gains arising from sale of equity shares. Income Tax Act provides concessional rates of tax on such profits. Intrigued? Let’s understand tax on your profits from stock market.

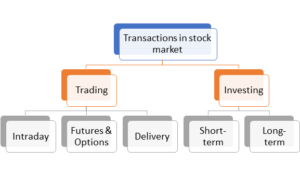

First, let us have an overview of the different types of transactions on the stock market:

Trader vs. Investor

Identification of yourself as a trader or an investor is the first step to calculation of tax. This is important because your tax liability may vary drastically for the reasons you will read later.

According to CBDT’s circular of 2016, “an individual can decide on his own to either show his stock investments as capital gains or as a business income (trading) irrespective of the period of holding the listed shares and securities. Whatever is the stance once taken, the taxpayer will have to continue with the same in the subsequent years.”

Income earned from trading on stock market are classified as “Profits & Gains from Business and Profession” and are taxed as business income. On the other hand, Gain made from investing are treated as “Capital Gains” and are taxed as such.

Capital Gains from Investment in stock market

You can identify yourself as investor if:

- Delivery of shares is taken in your DEMAT account;

- Shares are held for certain period before selling them;

- Dealing in shares is not your only source of income;

- Frequency of transactions is not very high.

Though, this is an illustrative list, consideration of these factors helps in justifying your classification.

Now that we have identified you as investor, let’s look at taxation aspect:

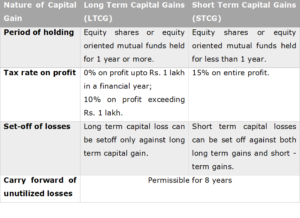

For instance you are allotted Zomato’s shares and you decide to sell them for listing gains. Such short term profits will be taxed @ 15%. However, if you choose to hold the shares for atleast a year and sell them later, your long term profits will be taxed at 0% or 10% depending on whether you have exhausted threshold limit of Rs. 1 lakh.

Note that above mentioned lower rates of tax are applicable only if the transactions (buy/sells) are executed on recognized stock exchanges. In case of off-market transactions, tax rate is 20% and 30%, respectively for LTCG and STCG.

Business income from Trading on Stock market

Income derived from trading on stock market can either be considered ‘speculative business income’ or ‘non-speculative business income’. These phrases are specifically in context of income tax.

Let us understand different tax treatment for each of these types of income:

High frequency of buy-sell transaction and share trading as your only source of income would be indicative factors to identify yourself as trader for the sake of delivery-based transactions.

Trader and Investor

In our above discussion, we asked you to identify yourself as either a trader or an investor. Now let’s explore if an individual can be both traders as well as investor.

Individuals filing their tax return as stock market traders may also be investing in the shares of good companies to build long term wealth. Will their profits be treated as business income when they sell those shares, say after 3 years?

In such cases, it is advisable to have 2 separate Demat accounts, one where trading activity is carried out and another where shares are held as investment. This way individual can claim to be both trader as well as investor.

Tax-loss harvesting – Tax planning, not avoidance!

Towards the end of a financial year, you might have realized profits and unrealized losses. Income Tax Act only recognizes actual realized profits and losses. It does not permit set-off of unrealized or notional losses. As a result, you may end up paying tax on profits booked despite having possible losses in your account.

Such outgo of tax can be postponed by booking the unrealized loss, and immediately getting back on the same trade.

Booking the loss reduces income and ultimately tax for that financial year.

Disclaimer: This article is for the purpose of general awareness and does not represent professional opinion of the author.

For any queries/clarifications/comments, please reach us at cakevalm@gmail.com.