Background

In past couple of months, it was reported that the Government of India (GoI) is likely to miss fiscal deficit targets due to revenue shortfall from taxes. The direct tax collection for F.Y. 2018-19 was projected at 11.5 Lakhs, which is likely to be missed. Against this backdrop, the income tax officers have been directed to gear up efforts to improve compliance with TDS (tax deducted at source) provisions of Income Tax Act.

TDS (Tax Deducted at Source)

TDS stands for tax deducted at source. As per the Income Tax Act, any company, firm/LLP or person making a payment is required to deduct tax at source if the payment exceeds certain threshold limits. TDS has to be deducted at the rates prescribed by the tax department. TDS is applicable on the various incomes such as salaries, interest received, commission received etc.

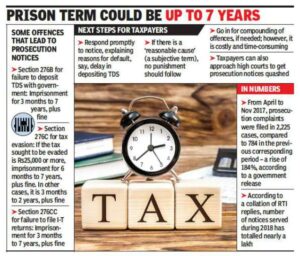

Non-compliance of TDS provisions

The non-deduction of tax or non-payment of TDS within time prescribed under the Income Tax Act, is treated as ‘default’. Accordingly, defaulting person, directors of defaulting company and partners of defaulting firm or LLP are liable to penalty and even prosecution. Sections 271C, 276B and 276C provide for levying of penalty and launching of prosecution under Income Tax Act, 1961.

Show-cause Notices for delayed payment of TDS

Owing to shortfall in tax collection as mentioned above, recently, the Income Tax Dept. has started sending showcause notices for delayed payment of TDS for F.Y. 2017-18. The prosecution notices are being sent to companies, firms and persons that paid their TDS for F.Y. 2017-18 after the due date, that is, 30/04/2018.

The notice received by such persons reads as below:

“It has been noticed from the details filed by you that the tax deducted/collected at source during the F.Y. 2017-18 was paid after 01/05/2018 i.e., after the due date(s) in contravention of the provision of chapter XVII B of the Income Tax Act, 1961.

You are, therefore, requested to please showcause as to why prosecution u/s 276B/BB of the Income-tax Act, 1961 should not be initiated against you.”

Notice further asks tax payer to ensure that TDS pertaining to F.Y. 2018-19 is deducted and deposited on or before the relevant due dates.

It is important to furnish appropriate response to show-cause or prosecution notices to prevent initiation of prosecution for defaults like delayed payment.

Source: Economic Times

It seems that, the notices are sent under the assumption that those who defaulted for F.Y. 2017-18 are likely to default for F.Y. 2018-19 as well. Therefore, the notices are primarily aimed to motivate tax-payers to timely deposit TDS for F.Y. 2018-19 and levying of penalty is a secondary motive.

If you have received show-cause or prosecution notice, kindly contact us at +91 9699111783 or just forward the notice to info@bhaskara in along with your contact details and we will get back to you with solution.

Disclaimer: This article is for general awareness and does not represent professional opinion of the author.