Like every indirect tax, input tax credit (ITC) is an important component of GST law. This article is aimed to enable entrepreneurs to evaluate GST impact on day-to-day procurement decisions without professional help.

Meaning:

Input tax credit is the GST paid on goods/services procured by the registered business which can be utilized to reduce tax on supply of goods/services by such registered business.

In other words, net GST liability payable in cash equals GST on sales less the amount of ITC available. However, excess of ITC (unutilized ITC) represents the blocked funds not available for business use.

Therefore, concept of ITC is relevant not only from legal perspective but also for better planning of cashflow.

Checklist to claim ITC under GST:

- Goods and services used for business.

- Tax invoice (of purchase) or debit note received from registered supplier.

- Actual receipt of the goods / services. (In case of goods, it may be evidenced through E-way bill.)

- Supplier/vendor has paid the tax charged on purchases in cash or via claiming input credit to the government. (Business can verify availability of credit in GSTR-2A every month).

- Supplier has filed GST returns. Therefore, only a compliant supplier can effectively pass on the input credit of GST.

- Goods or service should not be covered under blocked credit.

Blocked or disallowed credit:

Although GST paid on most goods and services procured for business can be claimed as input credit, GST law provides certain categories of purchases, GST on which cannot be availed as input tax credit. Some of them are:

- Purchase of motor vehicle, vessels and aircraft.

- Acquisition or construction of building for own use.

- Food, beverages, club memberships etc.

- Travel and conveyance.

- Any goods or services for personal use.

Ironically, GST paid on acquisition of office building cannot be availed as ITC but GST paid on rent of leased office premises can be availed as ITC. However, GST paid on both purchased and leased motor car is covered under blocked credit.

Manner to utilize ITC:

Understanding and optimization of set-off mechanism will help business optimize its working capital requirement. Thus, it becomes essential for an entrepreneur to be aware of manner of utilization of ITC.

In context of GST, ITC means the CGST, SGST/UTGST or IGST paid on procurement of goods/services by the business. It includes IGST charged on imports & tax payable under reverse charge mechanism.

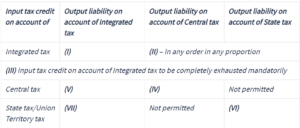

Input credit of CGST cannot be used to set-off liability of SGST. Similarly, input credit of SGST cannot be used to set-off liability of CGST. It is mandatory to utilize the entire IGST available in electronic credit ledger before utilizing ITC on CGST or SGST. The order of setting off ITC of IGST can be done in any proportion and any order towards setting off the CGST or SGST output after utilizing the same for IGST output. To summarize:

Reversal of ITC

In certain situations, ITC shall be reversed and has to be added to output liability along with interest thereon. One such situation is ‘Non-payment within 180 days.’ ITC will be reversed for invoices which are not paid within 180 days of issue. If part of the invoice is paid the ITC will be reversed on a proportionate basis.

We hope above lucid explanation will help entrepreneurs to plan their cashflow and GST payments effectively.

For any queries/comments/suggestions, please write to us at cakevalm@gmail.com

GST Clinic is a modest initiative by Bhaskara Consulting Group to help entrepreneurs get practical understanding of GST law and its impact on business processes.