“Save on cost center and spend on profit center” is the underlying mantra of every business.

In general sense, “cost center” means a department which does not produce directly but incurs costs to the business.

On the other hand, a profit center is a part of a business that is responsible for revenues and costs.

“Accounting & Book-keeping” function deals with recording and compiling financial data. Thus, apparently, unlike marketing or production function, it does not contribute actively and directly to the revenue.

Nonetheless, accounting and book-keeping is an essential function as it serves the twin objective of :

(1) Assisting informed decision making

An entrepreneur will always need on-demand and in-depth knowledge of their financial performance. At the same time, she will like to be informed of any material deviation, from plans and budgets. To achieve this, financial data generated, has to be converted into information, which supports intelligent analysis and facilitates better decisions for the organisation.

(2) Timely and accurate regulatory compliance

To ensure smooth operation of the business and avoid waste of time and energy into regulatory hurdles, it most important to comply with applicable regulatory requirements, timely and accurately. The efficiency of compliance entrusted to external professional ultimately hinges on financial data furnished to him.

Large business organisations have a separate team for accounting and book-keeping within their finance & accounts (F&A) division. However, start-ups and SMEs must carefully evaluate whether accounting and book-keeping function is a cost centre or a profit centre and then decide whether to save or spend, and if spend, to what extent.

In their efforts to minimise the costs, startups and SMEs often rely on accountants with lesser exposure to operations and business integration, to manage their financial information rather than taking professional help.

They fail to recognise hidden costs/losses arising from business decisions based on MIS (management information system) information obtained from the inaccurate recording of data. Let us understand this with an illustration:

Illustration: XYZ Pvt. Ltd. is a startup manufacturing electronic products.

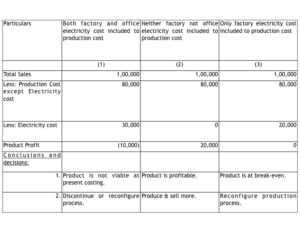

Accounting data: Selling price per unit – Rs. 1,000/-. Total 100 units produced and sold in a month. Production cost except electricity – Rs. 800 per unit. Electricity cost of factory is Rs. 20,000/- and that of office premises is Rs. 10,000/-.

MIS Information presented to business owner:

Several more decisions could be taken from the above information. Thus, inaccurate classification of an “electricity cost” can lead to disastrous business decisions. When such mistakes occur in accounting data involving several transactions, such data loses its potential to add value, and becomes “cost center”. However, if done rightly, financial information can enable quick decision making and acts as a “profit center” indirectly contributing to the growth of the business.

Similarly, startups and SMEs enter into a trap of avoidable complex litigations and resulting demands, arising from inaccurate data furnished in the first place. Let us understand this with the help of a case study.

Facts of the case: M/s ABC, a logistics company, received a notice of service tax audit. The department had asked for providing the reconciliation of various figures reported in financial statements vis-a-vis figures reported in service tax returns.

The company appointed 3-4 external consultants, successively, to handle the matter. Each consultant asked the company’s staff to prepare and provide reconciliation required for the service tax audit.

Issue: Due to the lack of accurate accounting data and several misclassifications made in accounting data handled by non-professionals, the staff was unable to provide required reconciliation.

Result: The appointed consultants refused to attend hearings due to the absence of any information to present before authority. The service tax authority finally passed ex-parte demand order of more than Rs. 70 Lakh. On failure to pay the demand, the company also faced freezing of bank account, which was released only after the company filed an appeal against the order.

It is amply clear that all of the above litigation and have been avoided if the company could have submitted timely and accurate information at the initial stage. Therefore, accounting and book-keeping, if done correctly, can help save a lot of time, energy and money which can be channelised to productive use of business.

On the other hand, it is also not prudent for startups and SMEs to inflate their costs by employing a professional for full-time. Thus, they may opt to outsource this function to an independent professional. Alternatively, they may choose to hire a full-time non-professional accountant and engage a professional to review their accounting on a weekly basis.

To sum up, professional help for accounting and book-keeping protects the business from GIGO (Garbage In Garbage Out) effect. Accurate inputs will lead to the correct output of MIS and compliance-related information, which in turn enhance the profitability of business.

Disclaimer: This article is for the purpose of general awareness and does not represent professional opinion of the author.

Makes a Nice read!

Nicely explained with relevant examples. A balancing act needs to be done to reap the benefits of proper accounting at reasonable costs.

Very relevant for start-ups and small businesses